In this article, we look at providing actionable tips for finance teams embarking on digital transformation. We cover key areas such as choosing the right technology, ensuring data security, and training staff for new processes. We finally look at how accounting software, such as Sage Intacct, can help in this area for your business.

Top tips for a successful digital finance transformation

In today’s digital landscape, the financial services industry is undergoing a transformation, reshaping how businesses operate and engage with their customers. The shift toward digital finance is not just a trend; it’s a strategic necessity for organisations looking to thrive in an increasingly competitive environment.

However, this can be complex, often fraught with challenges ranging from technology adoption to cultural shifts within the organisation. In this blog post, we’ll explore the top tips for a successful digital finance transformation, offering you practical insights and strategies to streamline your processes, enhance customer experiences, and leverage cutting-edge technologies.

Whether you’re a finance leader aiming to modernise your operations or a business owner seeking to stay ahead of the curve, this guide will equip you with the tools you need to embrace change and drive success in the digital age.

1. Understanding the Need for Digital Finance Transformation

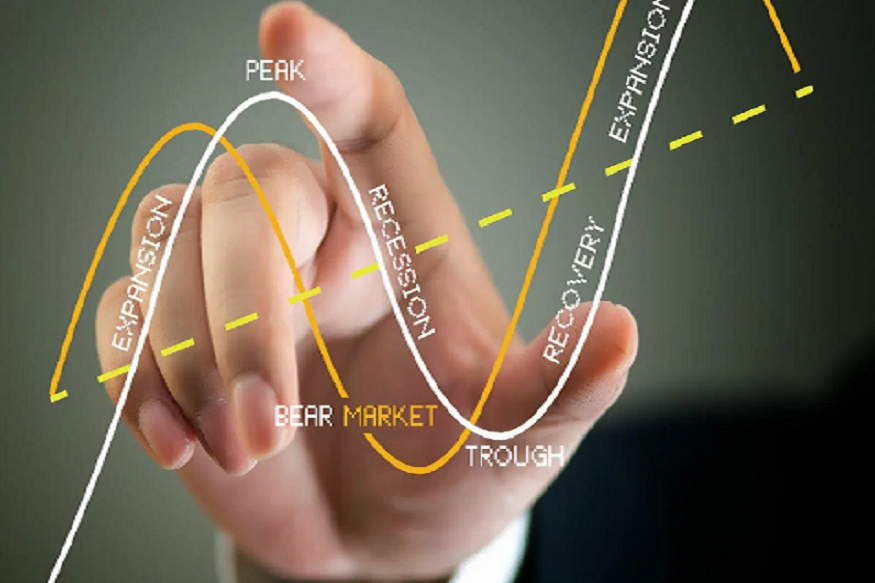

Understanding the need for digital finance transformation is the cornerstone of a successful transition into the modern financial landscape. As businesses increasingly operate in a digital-first world, traditional finance processes can quickly become outdated and inefficient. Organisations are finding that the conventional methods of accounting, reporting, and analysis no longer suffice in meeting the demands of agility, speed, and accuracy required by today’s market.

At its core, digital finance transformation enables companies to leverage technology to streamline operations, improve data accuracy, and enhance decision-making. This evolution is not merely about adopting new software or tools; it’s a shift in mindset that embraces innovation, data analytics, and real-time insights. By digitising financial processes, organisations can automate routine tasks, reduce manual errors, and free up valuable time for their finance teams to focus on strategic initiatives.

Moreover, understanding the need for this transformation also involves recognising the changing expectations of stakeholders. Investors, customers, and regulatory bodies are increasingly demanding transparency and up-to-date financial information. Digital finance transformation allows organisations to meet these expectations efficiently, providing stakeholders with timely insights that drive confidence and informed decision-making.

In essence, acknowledging the necessity for digital finance transformation is the first step toward unlocking new growth opportunities and achieving a competitive edge. Organisations that take on this change will not only enhance their efficiencies but also position themselves as leaders in their industries.

2. Assessing Your Current Financial Processes

Assessing your current financial processes is an essential first step in any successful digital finance transformation. This evaluation involves a comprehensive review of your existing workflows, tools, and methodologies to identify inefficiencies, bottlenecks, and areas ripe for improvement. Begin by mapping out your current financial operations, detailing everything from budgeting and forecasting to accounts payable and receivable.

Engage with key stakeholders across departments to gain insights into their day-to-day challenges. This collaborative approach not only helps pinpoint pain points but also fosters a sense of ownership and commitment among team members toward the transformation process.

Once you’ve gathered this information, analyse the data to highlight redundancies and manual processes that could benefit from automation. Look for key performance indicators (KPIs) that can provide a clearer picture of your financial health and operational efficiency. Are there tasks that take disproportionately long to complete? Are there recurring errors that could be alleviated with better tools or processes?

By fully understanding your current state, you can create a clear roadmap for your digital finance transformation, ensuring that the solutions you implement are tailored to your organisation’s specific needs. This foundational assessment not only sets the stage for successful change but also helps align your finance team’s goals with your organisation’s broader strategic objectives.

Ultimately, this thorough evaluation will empower you to leverage digital tools that enhance accuracy, efficiency, and strategic decision-making in your financial operations.

3. Choosing the Right Technology and Tools

Choosing the right technology and tools is a pivotal step in achieving a successful digital finance transformation. In an era where financial landscapes are continuously evolving, the technology you adopt can significantly impact your efficiency, accuracy, and overall business agility.

Start by assessing your organisation’s specific needs and challenges. What are the pain points in your current processes? Are you looking for enhanced data analytics, improved reporting capabilities, or streamlined transaction management? Understanding these requirements will guide you in selecting tools that align seamlessly with your business objectives.

Once you’ve identified your needs, it’s essential to research and evaluate various technologies available in the market. Look for solutions that offer scalability, allowing your financial systems to grow alongside your business, accounting software like Sage Intacct can help in these areas. Cloud-based platforms, for example, provide flexibility and remote accessibility, ensuring your finance team can operate effectively from anywhere. Additionally, prioritise integration capabilities. The ideal technology should work harmoniously with your existing systems, minimising disruptions during the transition and enhancing data flow across your organisation.

Don’t forget to consider user experience and training. The best tools are those that are intuitive and user-friendly, reducing the learning curve for your team. Investing in training and support will ensure that your employees feel confident using the new technology, fostering a culture of innovation and collaboration.

Finally, keep an eye on vendor reputation and support services. Reliable customer support can be invaluable during implementation and beyond, providing assistance whenever challenges arise. By carefully selecting the right technology and tools, you’ll set the foundation for a successful digital finance transformation that empowers your organisation to thrive in the digital age.

4. Fostering a Culture of Innovation and Change

Fostering a culture of innovation and change is pivotal for any organisation embarking on a digital finance transformation journey. This culture begins with leadership that not only advocates for change but embodies it in their daily practices. To cultivate this innovative spirit, it’s essential to encourage open communication where employees feel empowered to share new ideas and challenge the status quo without fear of retribution.

Implementing regular brainstorming sessions or innovation workshops can be an effective way to engage your team, allowing them to collaborate on creative solutions that can drive efficiency and enhance the overall financial strategy. Recognising and rewarding innovative contributions can further motivate employees to think creatively and embrace change.

Moreover, investing in continuous training and development is crucial. As technology evolves, so should your team’s skills and knowledge. Providing access to learning resources – be it through workshops, online courses, or industry conferences—ensures that your workforce remains agile and adept at leveraging new tools and methodologies.

By embedding a culture of innovation and change within your organisation, you lay the groundwork for a successful digital finance transformation that not only adapts to the future but thrives within it.

Who we are

If you would like to know more about successful digital transformation in your finance team, we can help.

We are a multi-award-winning company based in the UK offering Sage accounting software solutions. Itas Solutions provides services and support for all Sage products including Sage Intacct.

Being a multiple-award-winning Sage Partner is proof of our commitment to quality in the fields of financial transformation consulting and Sage technology.

Our team, which consists of technical professionals and transformation consultants, helps businesses use Sage software to maximise their financial processes.

Please email [email protected] or call +441824 780 000 to find out more about this and how we can assist you.